The Isle of Man has a rich and interesting history dating back to the Vikings. In fact it is not and has never been part of the United Kingdom despite being part of the British Isles. The Island is a self governing crown dependency. The Island’s parliament is known as Tynwald and dates back over 1,000 years and while the UK Government oversees the Island’s defence and foreign affairs, Tynwald is responsible for overseeing the Island’s domestic affairs which include taxation.

The Isle of Man has long had a reputation as a hub for corporate finances, particularly offshore and boasts a number of corporate and high net worth individual clients. The Island has enjoyed a strong economy for many years and has also been nominated as the best international financial centre at the International Investments awards 2019. The Island’s main economy used to be agriculture and fishing, but this was surpassed a long time ago by offshore banking, manufacturing and tourism. The Isle of Man has superb connections to the UK Mainland via its only airport and daily flights to Liverpool, Manchester, London and other airports are available.

Lawyers based in the Isle of Man are known as advocates and combine the roles of English solicitors and barristers. Manx advocates have an exclusive right in the Islands courts, although English barristers can be licensed to appear in certain cases and the Manx legal system is based on the principles of English common law, but has progressed to meet the Island’s special circumstances, particularly with regards to direct taxation, company law and financial supervision.

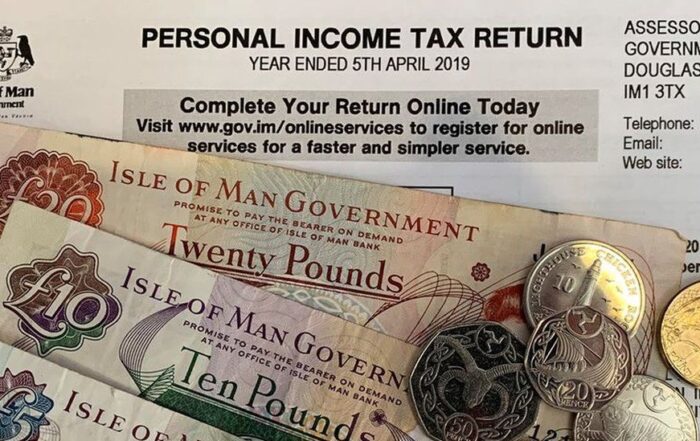

The Isle of Man currency is the pound sterling although the Government also prints the Manx Pound which is widely used throughout the Island.

Chesterfield Falcon Limited and the Isle of Man

Chesterfield Falcon Limited are highly skilled and have a team with significant experience when it comes to the Isle of Man and the services that we can offer. Our team has a mix of knowledgeable specialists in a number of fields which the Isle of Man offers and are here to help, guide and advise on whatever structure it is your wish to establish. We are licensed by the authorities in the Isle of Man and work closely with our clients to help them plan for the present and future and create structures for their individual needs. We have been based in the capital of the Island which is Douglas for over 25 years and our team can assist you every step of the way from initial structuring, including tax structuring, Asset Protection, Incorporating an Isle of Man Offshore Company, opening an Isle of Man Bank Account, Accountancy Services, providing Corporate Services including dealing with the Isle of Man Registry and Isle of Man VAT and Tax Registration.

Corporate Advantages of the Isle of Man

The Isle of Man is very attractive to businesses and people when it comes to setting up a company. One of the main reasons that people think of the Isle of Man, when considering incorporating an offshore company, is its reputation in the sector. There are however numerous advantages when it comes to the registering of an Isle of Man Company. Such as an attractive 0% corporate tax rate where the activity of the company is non Isle of Man based, no withholding tax, no capital gains tax and no stamp duty along with many other attractive qualities.

There is also double tax relief available for foreign tax paid through its double taxation agreements.

Company Formation in the Isle of Man

The Isle of Man offers a selection of companies such as Limited, Unlimited, Limited by Guarantee, LLC’s and Limited Partnerships. The main company’s which clients tend to incorporate is the Limited Company and there are two Acts, 1931 Act and 2006 Act, the 2006 is the more popular choice due to the reduced paperwork and flexibility it gives in administering the Company. Chesterfield Falcon Limited are able to incorporate any of the companies which the Isle of Man offer and once incorporated can offer a domiciliary service which includes registered office, agent, directors, secretary, nominated officer and shareholders. A Company name will need to be given to check and obtain approval at the Isle of Man Registry and it should not imply a regulated activity or contain any sensitive words or contain offensive language. The company name must end with a word/phrase/abbreviation such as Limited or Ltd, etc. Once the name is approved and full compliance has been obtained on the client Chesterfield Falcon Limited will be in a position to prepare and submit the incorporation paperwork at the Isle of Man Registry to incorporate the Company.

Due Diligence for New Isle of Man Companies

Financial Institutions in the Isle of Man have to be licensed by the Financial Services Authority. One policy which a Corporate Service Provider such as Chesterfield Falcon Limited must manage and maintain is to make sure that the take on procedure when they take on a new client is in line with their Anti Money Laundering Guidelines. Our take on procedure requires the client to complete an application form and provide identification and verification documents such as passport, address verification, CV and references. No two clients are the same so we don’t have one standard take on package that covers all our clients, we treat each client on a case to case basis and this will also depend on the activity, turnover, funds of the company, etc. Our compliance guidelines must be completed and checked before a company can be incorporated.

Company Administration and Provision of Directors/Secretary/Shareholders and Registered in the Isle of Man

Chesterfield Falcon Limited can offer all services you require when it comes to providing the officers to your newly incorporated company and the ongoing administration. Depending on which Act you require the company must have at least one director (individual or corporate for 2006 Act), two individual directors on the 1931 Act, none of the directors need to be resident on the Isle of Man (although beware of substance requirements), one Secretary is required for a 1931 Act, while it is not necessary to appoint a Secretary for a 2006 Act company. The shareholder for both Acts can be an individual or corporate and must hold at least one share. A registered office and nominated officer, which must be licensed, must be appointed for both of the Acts and for the 2006 Act Company a registered agent must be appointed.

Registry and Searches in the Isle of Man

The Isle of Man Companies Registry is located in Douglas. The Registry require all companies to complete, sign and file forms to incorporate a company, change the company’s officers, allotment of shares, etc and to keep Companies in good standing. Chesterfield Falcon Limited can assist with the preparation and filing of all forms for our clients. Company searches can be carried out in the Isle of Man and Chesterfield Falcon Limited are available to assist with any searches which are required.

Banking and Bank Account Opening in the Isle of Man

Banking has existed in the Isle of Man for the last two hundred years and has continuing growing at a rapid speed for the last number of decades. This is mainly due to the Governments support and incentives to help continue to boost the financial sector. There are a selection of United Kingdom high street banks represented on the Island and a small number of international banks are also present. The Isle of Man banking sector is renowned for its customer service, image and reputation. Once your new company has been incorporated Chesterfield Falcon Limited will assist in preparing the banking forms and paperwork for your new company bank account to be opened. The paperwork will be submitted at the bank of your choice or upon our recommendation, if you have no preference. Please note that we are able to introduce you to other banks elsewhere in the world if required.

Accounts for Isle of Man Companies

All Isle of Man companies have to prepare and file accounts with their annual tax return. A copy of the accounts must be kept at the registered office of the company. There are no requirements for accounts to be audited in the Isle of Man, unless certain specific criteria are met.

Tax Returns for Isle of Man Companies

Isle of Man companies must complete and submit a yearly tax return with a copy of the accounts for that period. This must be filed with the tax office in the Isle of Man. However, the information filed is not public.

VAT and VAT Registration in the Isle of Man

Although the Isle of Man is not been part of the United Kingdom, it is treated as part of the United Kingdom for VAT purposes. This means that imports and exports between the Isle of Man and the UK are not treated as such. VAT law in the Isle of Man is extremely similar to that of the United Kingdom and is administered by the Isle of Man Customs and Excise. You may need to register your company for VAT if it has a turnover of £81,000 per annum or more. Once registered then the company will have to prepare and file quarterly VAT returns. Chesterfield Falcon can plan, prepare and submit all necessary paperwork to the Isle of Man VAT office to have your company registered in a timely manner and ensure that all the statutory and regulatory requirements are met on a quarterly basis.

Summary

The Isle of Man Government continues to keep the Isle of Man’s reputation as an attractive place for offshore incorporation by continuing to introduce legislation in order to offer as broad a range of corporate structures as possible. Chesterfield Falcon Limited are experts at Isle of Man Company Incorporation and administration of Isle of Man companies and can assist in structuring an Isle of Man offshore Company to best suit your needs.

For any queries which you may have no matter how small or if you just wish to discuss what the Isle of Man can offer you, please do feel free to get in touch on 0162469550 and one of out dedicated team will be waiting to take your call and chat with you and discuss your questions. Alternatively, you can contact us by clicking here.

Please find below some links for the Isle of Man which you may find useful:

Isle of Man Government – www.gov.im

Isle of Man Financial Services Authority – www.iomfsa.im

Isle of Man Companies Registry – www.gov.im/categories/business-and-industries/companies-registry

Isle of Man Tax Office – www.gov.im/categories/tax-vat-and-your-money/income-tax-and-national-insurance

Isle of Man VAT Office – www.gov.im/categories/tax-vat-and-your-money/customs-and-excise

Latest Articles on Isle of Man

Restructuring your Business in the Isle of Man: Developing a Strategy with Chesterfield’s Expertise

In the ever-evolving world of business, restructuring is often necessary to adapt to changing market dynamics, optimise operations, and unlock growth opportunities. The Isle of Man is world-renowned for its favourable business environment, business-friendly

Family Office Set up in the Isle of Man

For high-net-worth individuals and families, setting up a family office can be a strategic move to consolidate and manage their wealth effectively. The Isle of Man, with its robust financial services industry, favourable tax

Offshore Banking in the Isle of Man: Exploring the Benefits

Offshore banking has long been a popular choice for individuals and businesses seeking financial privacy, asset protection, and international diversification. The Isle of Man, a renowned offshore financial centre located in the Irish Sea,

Trust and Trustee Services Offered by Chesterfield

In today's complex financial landscape, individuals and businesses often seek effective wealth management solutions that provide asset protection, estate planning, and privacy. Trusts have emerged as a powerful tool for achieving these objectives, offering

Fiduciary Services in the Isle of Man

The Isle of Man is a self-governing British Crown dependency located in the Irish Sea, between Great Britain and Ireland. It is a highly regarded international financial centre with a long-standing reputation for transparency,

Cryptocurrencies and the Isle of Man: Embracing Innovation in the Digital Economy

Cryptocurrencies, such as Bitcoin and Ethereum, have revolutionised the financial landscape, offering decentralised and secure digital transactions. As these digital assets gain widespread adoption, jurisdictions around the world are grappling with regulatory frameworks to

Relocating /Redomiciling your Company in the Isle of Man

Relocating or domiciling your company to a new jurisdiction can offer a range of benefits, including favourable tax conditions, a supportive business environment, and access to new markets. The Isle of Man, a self-governing

The Advantages of Setting up a Company in the Isle of Man

The Isle of Man, a self-governing British Crown dependency located in the Irish Sea, has long been recognised as a premier international business centre. Its robust financial services industry, political stability, attractive tax regime

Company Formation in the Isle of Man: Our Support Makes it Effortless

If you're considering establishing a company in a well-regarded international business centre, the Isle of Man is the ideal choice. Known for its political and economic stability, attractive tax regime and robust financial services industry,